Summary 2017

The year of 2017 saw the Chinese property market, in reaction to spiking prices and new government policies, pivot towards renting over buying.

Luxury compounds have long been a popular option for renters. They are usually large in size at an average of over 200 m2 and are centrally located. A layout of 2- to 4-bedrooms and a full-range of on-site facilities is the norm. Whilst facilities differ from one compound to the next, common offerings include 24-hour security, a pool, and a gym. The price of a 2-bedroom apartment ranges from ¥15,000 to ¥37,000, and a 3-bedroom ranges from ¥19,000 to ¥51,000. The market for this type of high-end apartment is well-established, giving renters a wide pool of options to choose from.

Due to their incredible service and central location, serviced apartments have become an increasingly attractive option for lessees. They offer flexible leasing options that suit both long- and short-term tenants. A range of premium services, such as regular cleanings and breakfast, add a layer of comfort and convenience for less than the cost of a high-end hotel. Layouts range from studio style to 3-bedrooms, with a 1-bedroom service apartment having around 100 m2. The price for service apartments is around ¥26-47,000 for a 2-bedroom, and ¥42-62,000 for a 3-bedroom. High quality local brands, particularly in Tier I cities, are more competitively priced and are experiencing growing demand.

One emerging portion of this sector is the concept of ‘corporate housing’, which refers to fully-furnished, temporary housing with add-on services such as cleaning services. Whereas standard serviced apartment companies will manage entire buildings, corporate housing operators usually oversee individual units across different compounds. In general, corporate housing is a more economical alternative to a standard service apartment, but typical offerings are less uniform and vary based on the management company and the unit.

With floor space averaging from 300 to 500 m2, villas are more spacious than the average apartment. In addition to having 3-bedrooms or more, villas typically come with a private yard. Residents also have access to a range of facilities within the compound, such as a children’s playground, spa, and gym. Although located far from the city center, the city’s most popular villa compounds are conveniently situated near elite international schools. Pricing for a 3-bedroom ranges from ¥28,000 to ¥61,000. And, if the prices are broken down by the square meter, villas emerge as one of the market’s cheapest luxury housing options. With their proximity to international schools, spaciousness, and cut-rate pricing, villas are particularly well-suited for families.

For more information about Shanghai apartment renting, please follow our website.

The country with one the world’s highest rates of home ownership is pivoting towards renting, and both supply and demand are on the uptick.

Market Overheating Leads to Government InterventionM.h4> Between 1997 and 2014, real estate as a percent of GDP grew from 4% to 15%. If the market’s links with upstream and downstream industries is taken into consideration, then a whopping 25% of GDP is real-estate related. In 2016 alone China’s tier I cities saw housing prices surge by as much as 55% year-on-year.

As signs of market overheating emerged, local governments began to implement a series of cooling measures, several of which are aimed at expanding the residential leasing market. Simultaneously, the astronomical price of home purchasing, particularly in Tier I city centers, coupled with the inconvenience of commuting from the suburbs and the emergence of tech-driven platforms has increased consumer interest towards renting over buying.

A pilot scheme was launched this year to build more rental housing in 13 different cities, including Beijing, Shanghai, and Guangzhou. Shanghai’s land authority has already released several batches of land for the sole purpose of residential leasing. This project, which is the first of its kind in the city, is aimed at providing 700,000 new rental homes by 2020. This would be equivalent to providing about 41% of new supply on the market. At the same time, new government restrictions towards home purchases is encouraging an increased interest in renting.

China’s home rental market is expected to more than double to reach ¥2.9 trillion by 2025. And a large portion of that demand will stem from a shift in Chinese consumer preferences. Although home purchasing costs are rising to become on par with other major international cities, Chinese buyers are facing a much larger price-to-income ratio at 15-25 times city-level disposable household income. Shanghai’s price-to-rent ratio is estimated to be about 50.05, far higher that NYC (17.71) or London (38.24). And although rental costs have also risen, they have remained low in comparison to home purchasing costs, driving demand.

Two of China’s internet giants have decided to penetrate the property market. Alibaba’s Alipay has introduced a new home rental platform that has made headlines with its “deposit free” feature that is available to customers with good credit ratings. Meanwhile, JD is luring property developers with big data-based solutions and inventory management. Both moves are expected to impact consumer behavior and demand levels. High-End Expat Relocation Company Maxview Group has also released an updated version of its Settle-In-China Shanghai website, which helps expats with their relocation needs by providing on-demand services and acting as an all-around guide for expats during their stay in China. Settle-In-China Beijing has an anticipated release date of Spring 2018.

Despite the rising cost of brand-name companies, serviced apartments are becoming increasingly popular due to the growth of competitively priced local brands.

The first quarter of 2017 saw overall high demand, low vacancy rates and falling rental costs. Even so, a strong first quarter ultimately led to mild rental price increases in the second quarter. Vacancy rates also rose as new projects entered the market, though some locations maintained high occupancy levels due to their location or flexibility over pricing. This trend continued through the fourth quarter.

Stanford Residences Xu Hui, Stanford Residences Jin Qiao, Capella Residences, Middle House Residences, Ten66 Serviced Residences, St. Regis Residential Apartments and a total of 3 new BASE Living Serviced Apartments were among those that opened their doors in 2017, adding over 1200 units to the market. Market supply is expected to see further growth in 2018 as demand ticks up, particularly amongst affluent Chinese locals who are increasingly prioritizing convenience and ease of living, in addition to a growing ‘try before you buy’ attitude amongst home buyers who wish to experience living in an area before they commit to purchasing a home.

Considering the relatively higher cost per square meter of choosing a serviced apartment over other high-end housing options, luxury compounds have historically been the preferred option. However, in Tier 1 cities there are now a number of viable local brands with high quality, low cost solutions. One notable example is Base Living, a boutique serviced apartment company that advertises studios at a starting rate of just ¥10,000.

Corporate housing, which refers specifically to specially-managed individual units, saw only moderate growth in 2017. Despite having the lowest prices in the serviced apartment sector, most residents still prefer the more comprehensive, uniform design of wholly managed complexes.

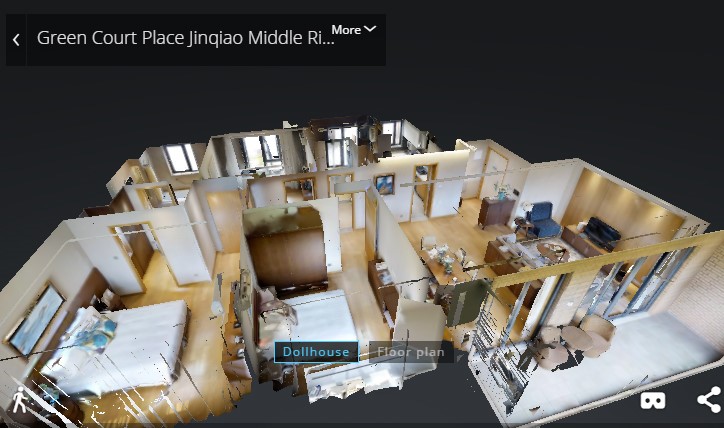

Despite the comparatively low prices of local brands, market adoption was initially sluggish due to a lack of brand familiarity. Yirent’s advanced space mapping technology, which was released in 2016, helped spur growth with its ability to allow potential clients to virtually tour units and get a ‘look-and-feel’ for each serviced apartment complex. The technology has even been adapted for use with VR devices.

Despite high occupancy rates, villas saw only mild year-on-year growth.

Despite their distance from the city center, villas remain popular due to their large size, proximity to elite international schools, and high levels of greenery. Although demand is largely driven by local elites, villas remain popular amongst expats with young children. Both supply and demand are expected to tick up in the long-term as city development expands.

Occupancy rates have remained stable in 2017, with the more popular compounds boasting full waiting lists. Villas, in comparison against Shanghai’s other residential housing sectors, continue to experience below-average vacancy levels at just 1.1%. Villa rents increased by just over 1% year-on-year.

Maxviewrealty, as the historic Shanghai real estate agency, has rich experience and advanced processes in housing rent in Shanghai.

The housing market recorded sluggish growth amidst pro-leasing government regulations and shifting consumer trends amongst younger buyers.

The overall Chinese housing market has continued growing year-on-year, albeit at a much slower place. Market demand is buoyed by a strong cultural preference for home ownership, which is further backed by a widespread belief in property investment as a secure investment. As of 2015 nearly 70% of per capita household wealth stemmed from real estate. And in many cities home ownership continues to be the biggest barrier to public resources, including schools, outside of the Hukou system.

Nevertheless, after a relatively strong first half, the pace slowed in the second half. A number of government measures, which included raising down-payment requirements and increasing scrutiny on property-related lending, helped stem the rate of home purchases. The cost of new housing in China rose at its slowest pace in 17 months in September. Tier I cities, which have the highest prices and therefore the tightest controls, were particularly hard hit. Price growth contracted by 0.1% year-on-year in Shanghai, and growth in Beijing slowed to just 0.5%.

At the same time, the relative affordability and convenience of renting has encouraged consumers, particularly from the younger generation, to turn towards the rental market. Increased demand is matched by the city’s goal of providing an additional 700,000 rental units between 2016 and 2020. With developers shifting their business model towards renting, the rental market is slowly becoming more sophisticated and a growing variety of hybrid, high-end leasing options are on offer.

For foreigners looking to buy in Shanghai, the process and requirements remain relatively the same. Expat buyers are required to provide proof of having lived in the city for at least 12 months. Required documentation may include tax records, employment contract, work permit and residency permit. Foreigners are not permitted to buy commercial property, or purchase a home with the intention of using it as a rental property. Expats are potentially eligible for a mortgage loan, but it may only cover a maximum of 70% of the property’s value. The average cost of residential property per square meter ranges from about ¥57,840 in Pudong to ¥95,359 in Jing’an.

This year saw 2016’s 3-tier, point-based work visa pilot program come into effect nationwide, causing a slight downturn in expat numbers as corporations adjusted. Many new slight policy changes were implemented aimed at streamlining the application procedure.

Under the previous work permit system, applicants either received a standard work permit (Z) or a rare talent visa (R). These visas were handled separately by the Ministry of Human Resources and Social Security (MOHRSS) and the State Administration of Foreign Expert Affairs (SAFEA), making the process largely bureaucratic and confusing for applicants.

In an effort to streamline and clarify the process, the separate Z and R visas were combined into a 3-tier, point-based system. The new system takes many factors into account, including salary, education level, and years of experience. Applicants are divided into three categories: Class A, B or C. Applicants who score 85 or more points are categorized into Class A. Applicants who score between 60 and 85 points are classified as Class B. And applicants who score less than 60 fall automatically into Class C.

Class A has replaced the R-visa and is earmarked for highly skilled individuals who are at the top of their respective fields. Applicants who qualify for this tier are not required to meet all of the requirements of a standard work visa, such as age or academic degree. In addition, the review and approval timeline for these individuals is considerably shorter than for other applicants.

However, most foreigners fall into Class B, which is for degree holding applicants with work experience. Preference is given to foreigners who plan to work in certain, in-need fields. In comparison to Class A applications, the procedure is relatively strict and time consuming.

Class C is for unskilled or temporary work positions. This section includes internships, seasonal jobs in tourism, and short-term business assignments. Applicants in this category are subject to stricter quotas and shorter validity periods.

Outside of the new 3-tier system, a number of targeted visa policy changes are either being tested or adopted. Foreign students are now able to obtain a work visa within one year of graduation, waving the requirement for two years of post-graduate work experience. The requirements for the permanent residency permit have also been lowered, with application approvals spiking 163% in just one year. And in a number of key cities, including Beijing, a new trial program is allowing expats to apply for a five-year work permit after just two years of consecutive employment in China.

Near the end of the year, several additional policies were announced in Shanghai, targeting to streamline the application process. Due to that the visa policies are still city and region based; these policies are currently affecting Shanghai only.

The policies aimed at streamlining the process, announced that all work permit applications from now on had to be processed online. At the same time the governmental bureau announced that all work permits applications will receive all notification of any rejections in ‘one-go’ in the online preliminary review (previously applications encountered repeated revisions, rejections and requests for additional information). Now the policies were set in place to announce a list of the rejection in one step, part of their ‘two-step’ policy aimed at streamlining the procedure, reducing time needed. The second step of handing in the documentation at the exit-entry bureau for examination will now be fully accepted, if they meet the requirements. If the application is not accepted, after this two-step process, the application officer will have to contact the applicant company to complete the service.

The last major policy introduced this year in Shanghai was that all work permit holders need to renew their work permit a minimum of 30 days before the expiry, any application handed in later than that will not be accepted.

The 2018 outlook for visa and immigration services will likely continue the trend of streamlining the procedures. Currently it is not foreseeable that nation-wide visa policies will be enacted in 2018 and continue with the city and region determined policies, but with the procedure now partly online it is one step closer towards a unified system.

Recent government regulatory measures towards China’s real estate market, in combination with estimates that an additional 100 million people will migrate to city centers over the next few years, has led industry experts to forecast a potential growth of over one trillion for the rental market over the next several years.

A rising number of developers are shifting their operations in reaction to this trend. Already the market is seeing an increasing number of customizable, boutique offerings. In the serviced apartment sector, local brands are becoming increasingly savvy competitors against more-established, big-name brands.

As competition intensifies, older projects will need to improve management and quality levels in order to maintain their market share. Although supply is forecasted to expand in coming years, a rise in demand will likely cause prices to rise as well.

Demand for luxury housing is driven more and more by local Chinese renters as property purchasing controls tighten and the housing supply near elite schools dries up. Renters from the younger generation are also enticed by the relatively more affordable rental prices, as well as the range of available on-site services and facilities.

In 2017 a few new high-end projects entered the rental market. Stanford Xuhui, which opened its doors this year, is expected to add an additional 100 units in the first quarter of 2018. Additionally a local service apartment brand, BASE Living, expanded rapidly this year with a total of 3 new projects, located in Fuxing Road, Pusan Pudong and Zhangjia Pudong. Their targeted market at providing high-quality, yet affordable living spaces in convenient locations has captured much market share since their first Shizhiwan project in 2013. Setting the trend, it is estimated many more local brands will follow in their footsteps, in a market that is currently dominated by International brands such as Ascott, Fraser and more.